What is Depreciation?

페이지 정보

본문

By including up all the units produced in a single yr, you get the amount to put in writing off. As soon as all of the units have been written off, depreciation of the asset is full-its useful life is technically over, and you can’t write off any extra items. Since hours can depend as units, let’s stick to the bouncy castle instance. Let’s say that, in keeping with the manufacturer, the bouncy castle can be used a complete of one hundred,000 hours before its useful life is over. Additionally, particular leasing arrangements may offer further tax deductions, improving your after-tax returns. In times of inflation, asset leasing can present a hedge towards rising costs. For instance, leasing actual property or equipment might permit you to regulate rent or lease funds to mirror inflationary pressures, preserving the worth of your funding over time. Asset-based mostly leasing provides regular returns and portfolio diversification, however there are a couple of considerations that it's best to keep in mind to maximise your positive aspects. One key facet is the lessee’s capacity to take care of payments.

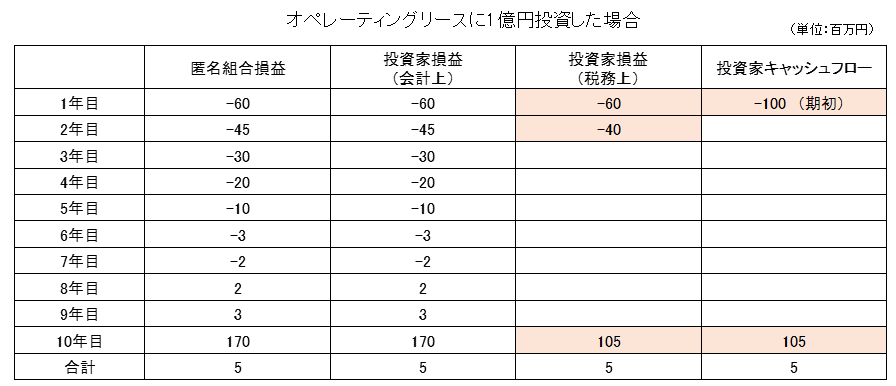

Working leases serve as a strategic software for corporations to manage their assets and funds more successfully. They offer a blend of financial, operational, and risk management benefits that may be tailored to satisfy the particular wants of a enterprise, making them a versatile choice in capital funding planning. By fastidiously considering the strategic advantages of working leases, corporations can make informed choices that align with their lengthy-time period targets and market dynamics. Operating leases play a pivotal role in capital budgeting selections, offering corporations a strategic device to manage their assets and funds. By proactively assessing tax implications and strategizing their tax planning accordingly, businesses can optimize their cash stream, allocate sources more effectively, and improve their total profitability. 1. Timing and shifting income and bills: It entails strategically timing revenue recognition or transferring income to different entities or tax durations. By postponing revenue to a subsequent tax year or allocating it to members of the family or associated entities in lower tax brackets, companies can significantly decrease their tax obligations. 2. Profiting from business tax deductions: By carefully analyzing eligible expenses, comparable to enterprise-associated prices, worker benefits, or charitable contributions, businesses can claim deductions and lower their overall tax burden.

Underneath an working lease, the corporate can deduct the total quantity of the lease payments annually, providing a tax shield. While operating leases can provide significant tax benefits, particularly by way of fast expense recognition, they should be carefully considered within the broader context of an organization's monetary technique and the changing landscape of tax laws and accounting standards. It is always recommended to seek the advice of with a tax skilled to know the precise implications for your business. 14 million (married couples). How Can I Maximize the Property Tax Exemption Earlier than the Tax Cuts and Jobs Act Provisions Expire? Thirteen,610,000 tax-free, which may even cut back your taxable property. Any gifts made by means of lifetime gifting can be shielded by the anti-clawback rule as soon as the TCJA provisions sunset. This ensures your property will not be taxed on gifts made in the course of the increased exemption period (2018 to 2025) at loss of life. 2,644,000 of potential tax financial savings misplaced (per partner). To maximize the property planning alternative of the elevated exemption, the present(s) you make ought to use extra of your exemption than will probably be obtainable after sunset.

5. Evaluate social security benefits. Should you gather social security, you may benefit from strategies to reduce or オペレーティングリース 節税スキーム defer taxable earnings. If your non-social security revenue exceeds certain ranges, it triggers taxation of a higher proportion of your social security benefits. 6. Concentrate to recordkeeping. Maintaining complete data may make it easier to save on taxes, especially if it prevents having to locate or recreate the information. The Initial right-of-use asset and lease legal responsibility are calculated. On the Lease classification check FastTab to check the Lease sort value. The computerized Lease sort is categorised primarily based on the standards which can be defined on the Books web page. Go to Payment schedule under the Perform part. The Fee schedule page lists future cost schedules for a lease ID.

- 이전글Bob 15 minutes A Day To Develop What you are promoting 24.12.28

- 다음글레비트라 효능 비아그라효능 24.12.28

댓글목록

등록된 댓글이 없습니다.